Minnesota Republicans love to portray Minnesota as a liberal la-la land that unfairly victimizes their oppressed wealthy donors by “soaking them” with high taxes.

Not true. The reality is, Minnesota’s state and local taxes remain regressive, meaning that the rate of taxation actually decreases as incomes increase.

This is wrong. Those with higher incomes should pay a larger proportion of their income in taxes, because they can afford to do so without suffering as much of a blow, proportionally speaking, to their quality of life.

Conservatives typically point to state income tax rates to make their case, because that tax is indeed progressive. The problem with that tired old spin is that the income tax is far from the only tax. Minnesotans also pay sales, property, and excise (on alcohol, tobacco, and motor fuels) taxes, and those taxes are all very regressive. That is, those types of taxes all hit people with lower incomes much harder, as a percent of income, than they hit people with higher incomes.

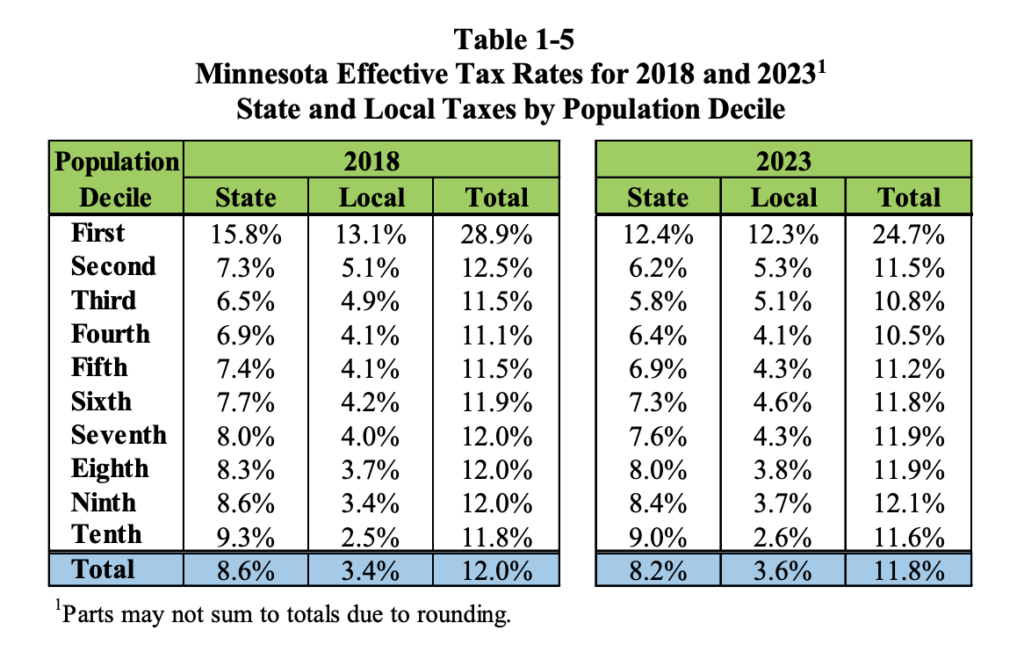

So the most relevant measure of whether Minnesota’s overall tax system is based on the ability-to-pay is the effective tax rate for all state and local taxes combined. Every year, the Minnesota Department of Revenue calculates this amount. Here is what the most recent version looks like.

Here are a few important things to note:

- Tax Burdens Are Decreasing, Not Increasing. Between 2018 and 2023 (projected), tax burdens are decreasing at every level of income. Remember this the next time you hear conservatives whining about “skyrocketing taxes.”

- Progressivity Is Improving, But Not Enough. Between 2018 and 2023 (projected), the gap between the effective rate for the poorest and wealthiest Minnesota pay is narrowing , but it’s not a large or sufficient improvement. The arc of the moral universe is bending towards justice, but it’s a painfully slow rate-of-change.

- Minnesota’s Taxes Remain Very Regressive. This is the most important thing to take away from this chart. Minnesota still has a very regressive tax system that hits poor people much harder than rich people. Minnesota’s poorest taxpayers pay a 24.7% state and local tax rate, while our wealthiest taxpayers only pay 11.6%.

Before you shrug this off, stop and really think about it. The wealthiest Minnesotans are required to pay less than half the tax burden the poorest Minnesotans are required to pay. For those who want Minnesota to be a more just and equitable place, the work is far from done.

Yes, stalwart conservative protectors of the wealthy will be quick to say, but the wealthy pay much larger tax bills than the poor! This is true. But it’s also true that when someone at the bottom of the income heap has to pay 24.7% for taxes out of their nearly empty wallet, that takes leaves a lot less to provide for their family than when the wealthiest Minnesotans only have to pay 11.6% for taxes out of their much fatter wallets and investment portfolios. The poor person may not be able to pay rent, while the rich person may only need to leave ever so slightly less to their already well-pampered scions.

Every time someone proposes asking the wealthy to pay more in taxes, wealthy news anchors, pundits, and politicians breathlessly characterize the proposal as “controversial” and “unrealistic.”

For what it’s worth, Americans disagree. For instance, a POLITICO/Morning Consult poll found an overwhelming 76 percent of registered voters believe the wealthiest Americans should pay more in taxes. It might be controversial at the large donor soirees, but not most other places in America.

So when Minnesota DFL legislators propose, as they did this year, to create a new fifth tier state income tax rate of 11.15% on income above $1 million (or $500,000 for single filers), don’t fall into the trap of repeating the conservatives’ well-focus grouped “it’s soaking the rich” narrative.

Instead, look at these data and say “it’s a start.”