Not so long ago, there was a strong national consensus in favor of progressive taxation. In the 1980s, conservative Ronald Reagan was running around telling his followers:

“We’re going to close some of the loopholes that allow some of the wealthy to avoid paying their fair share. In theory, some of those loopholes were understandable. But in practice, they sometimes make it possible for millionaires to pay nothing, while a bus driver is paying 10% of his salary, and that’s crazy.

…Do you think the millionaire ought to pay more in taxes than the bus driver or less?

(Crowd: “More!”)

That was then, but this is now. Now, conservatives call conservative Reagan’s pro-progressive tax position “socialism” and “anti-American,” a sign of just how radicalized Republicans have gotten in their desperation to pander to conservative talk radio hosts, wealthy donors, and Tea Party primary challengers.

Among the most radical things that Republicans now push is a flat tax. While a flat tax is attractive at first blush because it is simple compared to the maddeningly complex federal income tax, it is the polar opposite of the progressive income tax that Reagan championed. While a progressive tax is designed to take a larger percentage from the income of high-income earners than it does from low-income individuals, the flat tax takes the same percentage from everyone, whether you are a bus driver or a billionaire.

As the Founding Father of the modern conservative movement said, “That’s crazy.”

Yesterday in a Minnesota Public Radio interview, Minnesota Governor Dayton made an interesting point on this subject. When asked what kind of tax reform he favors, Dayton said:

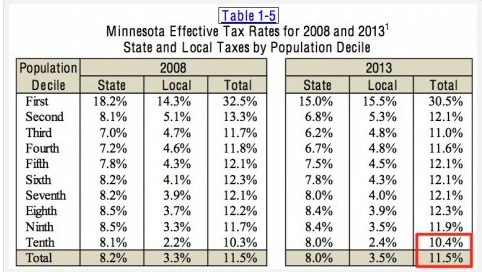

I still believe in a progressive income tax. But I sure don’t believe in a regressive income tax, which is what we have now. …Conservative Senator Rod Grams was always talking about a flat tax. Well that would be an improvement in Minnesota! We have less than that now.

Ponder that. A flat tax – which embodies the radical anti-progressive notion that conservative icon Ronald Reagan not so long ago mocked as “crazy” to the delight of his conservative followers – actually would be an improvement over the regressive tax system that Minnesota currently has on the books today.

Millionaire Mark Dayton is often characterized, by opponents and even by mainstream reporters, as favoring a “soak the rich” ideology. That’s a silly characterization, because what Dayton actually proposes is not to “soak” the wealthy. What Dayton recommends is simply a return to the common sense notion of progressive taxation supported by a strong majority of Minnesotans, and even the founder of the modern conservative movement.

Millionaire Mark Dayton is often characterized, by opponents and even by mainstream reporters, as favoring a “soak the rich” ideology. That’s a silly characterization, because what Dayton actually proposes is not to “soak” the wealthy. What Dayton recommends is simply a return to the common sense notion of progressive taxation supported by a strong majority of Minnesotans, and even the founder of the modern conservative movement.

– Loveland