Every year, we hear the State Legislature endlessly debate “water cooler” issues, such as Sunday liquor sales and legislator pay. Meanwhile, we hear almost nothing about more fundamental issues of governance, such as whether we have a taxation system that treats Minnesotans fairly.

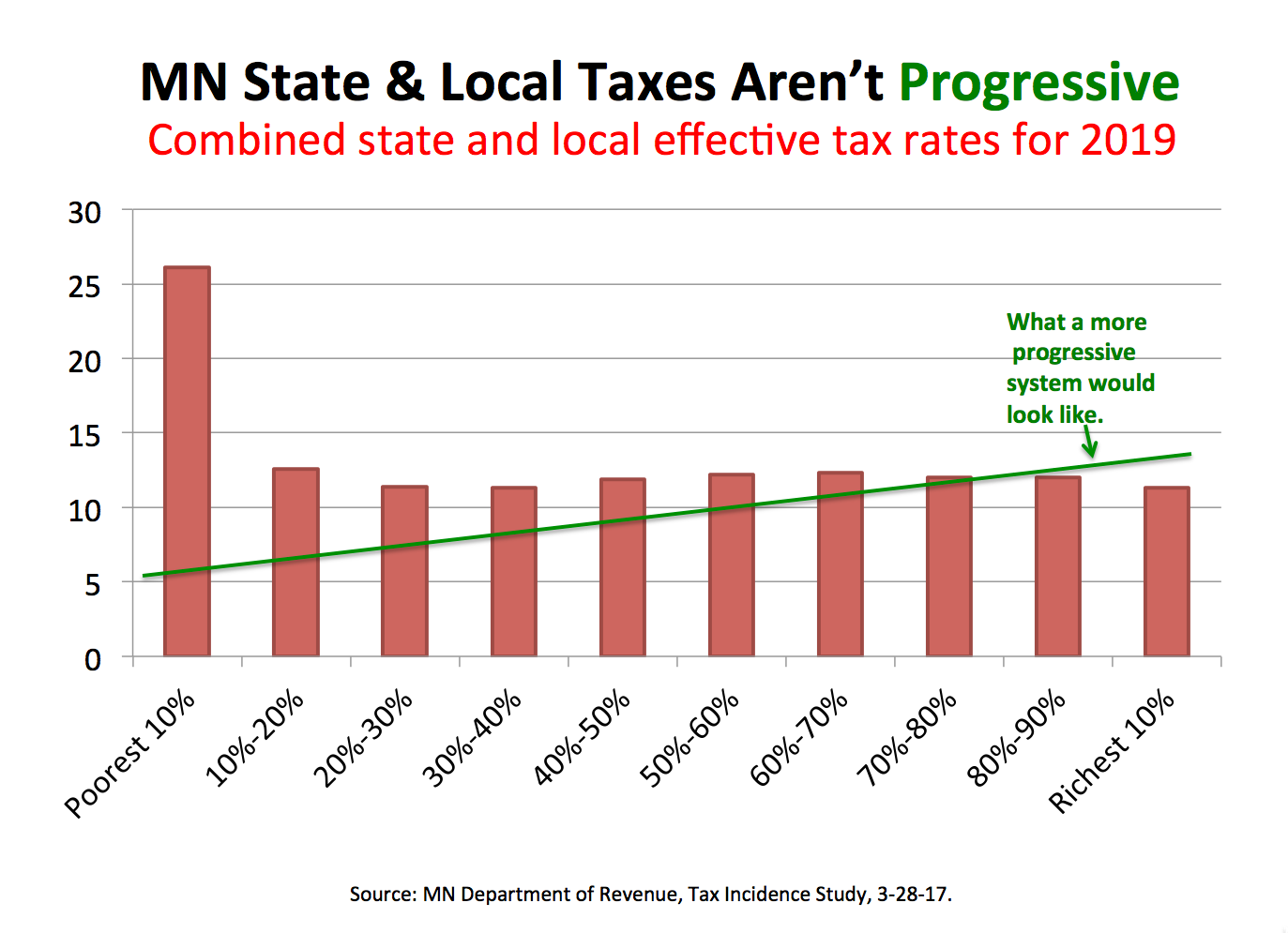

When you look at Minnesotans’ effective state and local tax rate — the proportion of income paid in combined state and local taxes – it’s clear that we don’t have a progressive system. That is, we don’t a tax system where the rate of taxation increases, or “progresses,” as income increases. This chart based on Minnesota Department of Revenue data paints a pretty clear picture:

Note: Department of Revenue study authors point out that “effective tax rates in the 1st decile are overstated by an unknown but possibly significant amount.” If you want to know why, there’s an explanation on page seventeen of the study.

However, even disregarding that first bar for the purposes of this discussion, we can certainly say that Minnesota has a state and local tax system that is not very progressive. That is, it is not taxing Minnesotans according to relative ability to pay.

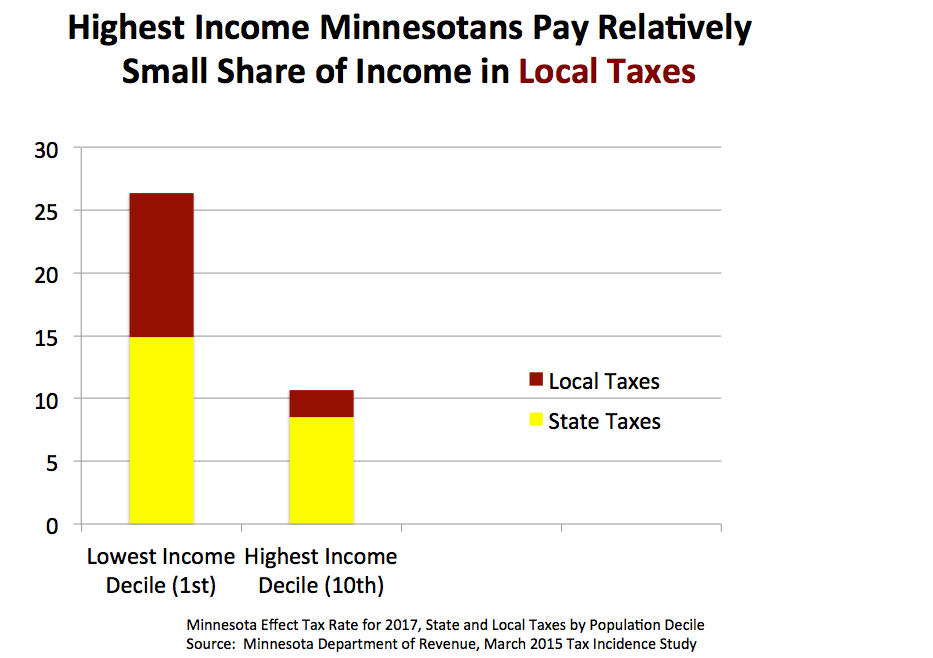

As you can see in this chart, local taxes in Minnesota are particularly regressive. Compared to other income groups, the wealthiest Minnesotans are paying the smallest share of their income in local taxes. So if state lawmakers want tax fairness for Minnesotans, and they can’t rely on local officials to reform local taxes, then they need state taxes to be more progressive to offset those regressive local taxes.

Before my conservative friends trot out their tired old “socialism” rhetoric, they should read the words of Adam Smith, the father of free market economic theory who conservatives worship, on the subject of progressive taxation:

“The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess … It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion.”

Republicans should also keep in mind that the nation’s first progressive income tax was enacted when the revered father of the Republican Party, Abraham Lincoln signed the Revenue Act of 1862. A few decades later, Teddy Roosevelt carried on this Republican tradition when he strongly advocated for progressive taxation:

I believe in a graduated income tax on big fortunes, and in . . . a graduated inheritance tax on big fortunes, . . . increasing rapidly in amount with the size of the estate.

The fact is, until relatively recently Republicans were comfortable with much higher top income tax rates than they are today. While the top rate under Democratic Presidents Obama and Clinton was 40%, the top rates were 91% under Republican President Eisenhower, 70% under Republican President Nixon and 70% under Republican President Ford.

So, to my right wing friends, you’re embarrassing yourselves when you call progressive taxation “Marxism.” For more than a century, progressive taxation was mainstream Republican thought. Don’t let the uber-wealthy interests who seized control of the Republican Party in more recent years blind you to that fact.

To my friends in the center, spare me the “be reasonable” lectures you deliver every time progressive taxation is proposed. Unless moderates also view Presidents Eisenhower, Nixon and Ford as wild-eyed extremists, you need to stop characterizing progressive taxation proposals as being somehow “radical.”

Finally, to my progressive friends, show some courage and leadership. Don’t get so obsessed with shiny objects, like the Sunday liquor sales issue. Don’t shy away from fighting to make our state and local taxation system more fair. It’s time for DFLers who are “progressives” in name to become more progressive when it comes to substance.

This is a point that is frequently missed, or intentionally ignored, by people who focus solely on state tax burdens, without also taking local tax burdens into consideration.

This is a point that is frequently missed, or intentionally ignored, by people who focus solely on state tax burdens, without also taking local tax burdens into consideration.