In the first year that Minnesota Republicans took full control of the Minnesota Legislature, they elevated Minnesota’s millionaire heirs and heiresses to the very top of their fiscal priority list. Representative Greg Davids (R-Preston) says the wealthiest Minnesotans should be able to “keep more of what their mothers and fathers and grandfathers and grandmothers have earned,” so Republicans significantly increased the’ estate tax exemption for millionaires.

In the first year that Minnesota Republicans took full control of the Minnesota Legislature, they elevated Minnesota’s millionaire heirs and heiresses to the very top of their fiscal priority list. Representative Greg Davids (R-Preston) says the wealthiest Minnesotans should be able to “keep more of what their mothers and fathers and grandfathers and grandmothers have earned,” so Republicans significantly increased the’ estate tax exemption for millionaires.

To be clear, we’re talking about filthy rich grandfathers and grandmothers, After all, only the very wealthiest Minnesota estates pay any estate tax. According to the Minnesota Public Radio:

“Up until now, your estate would have to be worth more than $1.8 million before the Minnesota estate tax kicked in, but that changed during this year’s legislative session.

The tax bill passed by the Republican-controlled Legislature and reluctantly signed by DFL Gov. Mark Dayton increases the taxable estate value from $1.8 million to $3 million over the next three years. The top tax rate remains at 16 percent.

Minnesota is among 14 states that impose their own estate tax. Farms and family-owned businesses worth up to $5 million are already exempt.”

So, we’re not talking about the four-, five- or even six-figure inheritance you might get from Aunt Gertie.

All of this is being proposed by Republicans at at time when wealth inequality has reached grotesque proportions, as illustrated by this stunning video:

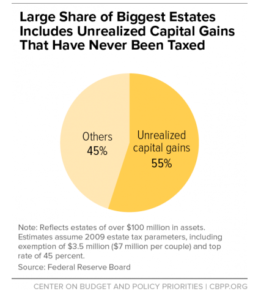

This is how intergenerational privilege perpetuates: Millionaire heirs and heiresses – having done nothing more than winning the birth lottery by being born into a wealthy family — are exempted from taxation, including for wealth that has already avoided taxation because it is unrealized capital gains.

This is how intergenerational privilege perpetuates: Millionaire heirs and heiresses – having done nothing more than winning the birth lottery by being born into a wealthy family — are exempted from taxation, including for wealth that has already avoided taxation because it is unrealized capital gains.

And on it goes, generation after generation. This is how we get the Donald Trumps and Donald Trump, Jr.’s of the world, entitled scions born inches from home plate crowing about their home run.

To state the obvious, because it apparently is no longer obvious to everyone, this is not in keeping with the American value of “all men are created equal,” which used to be all the rage in America. America was founded in defiance of the British system of aristocracy, which gave power to a small, wealthy privileged “ruling class.” Abolishing aristocratic forms of inheritance was a primary way the founding fathers went about furthering American equality.

While today’s Republican Tea Partiers don Revolutionary War-era tri-corner hats while asserting that the estate tax is “Marxist,” the truth is that the estate tax has been strongly supported by a number of founding fathers.

While today’s Republican Tea Partiers don Revolutionary War-era tri-corner hats while asserting that the estate tax is “Marxist,” the truth is that the estate tax has been strongly supported by a number of founding fathers.

Remember Thomas Jefferson, the guy who penned “all men are created equal,” America’s “immortal declaration?” He promoted the egalitarian values of America’s founding fathers by arguing against the passing of property from one generation to the next:

“The earth and the fulness of it belongs to every generation, and the preceding one can have no right to bind it up from posterity. Such extension of property is quite unnatural.“

Jefferson was hardly alone in this opinion. Similar sentiments were expressed by Adam Smith, the hero of conservative free market advocates, as well as Republican Party icon Theodore Roosevelt.

“The absence of effective state, and, especially, national, restraint upon unfair money-getting has tended to create a small class of enormously wealthy and economically powerful men, whose chief object is to hold and increase their power. The really big fortune, the swollen fortune, by the mere fact of its size acquires qualities which differentiate it in kind as well as in degree from what is passed by men of relatively small means. Therefore, I believe in … a graduated inheritance tax on big fortunes, properly safeguarded against evasion and increasing rapidly in amount with the size of the estate.”

You might guess that someone like Bill Gates, Sr. would be all-in when it comes to increasing the estate tax exemption. But he eloquently explains why the wealthy people need to pay back the community that supported them:

“No one accumulates a fortune without the help of our society’s investments. How much wealth would exist without America’s unique property rights protections, public infrastructure, and academic institutions? We should celebrate the estate tax as an ‘economic opportunity recycling’ program, where previous generations made investments for us and now it’s our turn to pass on the gift. Strengthening the estate tax is important to our democracy.

Consider all of the other alternative ways Minnesota Republicans could have used the $357 million that they are giving to Minnesota’s wealthiest heirs and heiresses over the next two bienniums. They could have used it to improve our transportation or broadband infrastructure, help vulnerable children access early learning programs to close our dangerous achievement gaps, or expand clean energy capacity. Those kinds of investments would have paid dividends for all Minnesotans far into the future.

Instead, Republicans made their top priority lavishing more enormous tax breaks on the small number of ultra-wealthy Minnesotans who least need help.

Governor Dayton has already signed the Republicans’ estate tax exemption, so at this point he has little if any negotiation leverage. But if Democrats take control of state government in 2018, this should be one of the first policies they reverse in 2019. In the meantime, at every campaign stop they should spotlight this outrageous Republican giveaway to the wealthy elite.