Minnesota GOP gubernatorial candidate Scott Honour has a surname that sounds as if it was fabricated by a team of political consultants. What, “Bob Dignity” wasn’t available to run for governor?

I don’t know a lot about Mr. Honour’s pre-political life, but from what he has published on his website biography, he sounds like a pleasant chap and a capable business person.

But so far, his performance since becoming a politician does not live up to the expectations set by his surname.

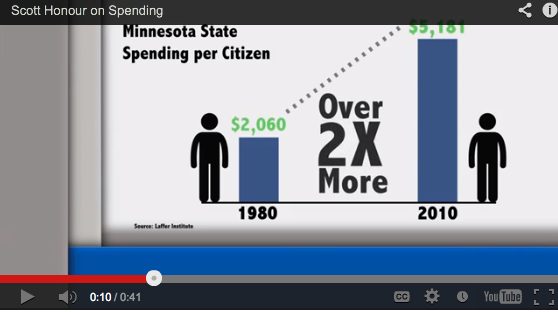

Mr. Honour has been busy making the case that Minnesota state government spending is out-of-control. For instance, this campaign video claims:

“Did you know that our state is spending over twice as much per citizen as when I graduated from high school in 1984? It sure doesn’t feel like we’re getting twice as much value for our money.”

That’s a potent political statement. But is it an honorable statement? A truly honorable leader would acknowledge that the median household income when Mr. Honour graduated from high school in 1984 was $22,415.00, while in February 2013 median household income had grown to $51,404, more than twice as high as it was in 1984.

As a successful businessperson, Mr. Honour surely understands that as household incomes have more than doubled between 1984 and 2013, the cost of just about everything else, including the major things government has to purchase – medical care, medical devices, pharmaceuticals, energy, asphalt, private and public sarlaries, technology, real estate, construction materials, etc. — have also gotten dramatically more expensive. He is a bright and experienced enough businessperson to understand that economic reality, but he is not honorable enough to publicly acknowledge it.

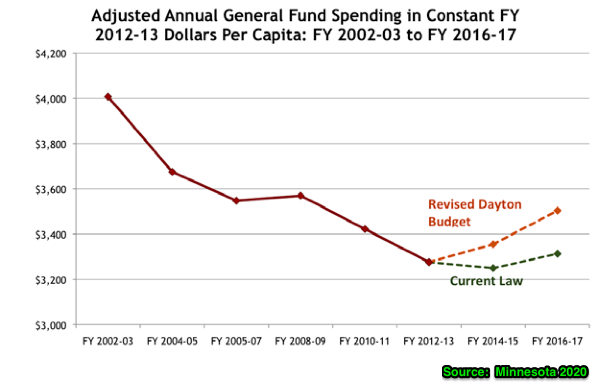

So what’s the truth about state government spending in Minnesota. A thoughtful and thorough Minnesota 2020 analysis recently found:

Adjusted for inflation, accounting shifts, state takeovers, and the tobacco bond sale, Minnesota is spending about $5.2 billion less (in 2012-13 dollars) than it was a decade ago. That’s roughly $730 less per capita, or an 18 percent decline in state expenditures.

Claims of rapid state spending growth are based on comparisons that fail to account for inflation, population, school funding shifts, and other one-time events that distort spending over time.

If legislature implements Governor Dayton’s current budget plan, by FY 2016-17 Minnesota’s adjusted per capita spending would still be $500 less than it was a decade ago (FY 2002-03).

To be fair to Mr. Honour, he is far from the only conservative to be engaged in this type of simplistic demagoguery. For instance, on May 18, 2013 the conservative Pioneer Press editorial board titled their editorial “Minneosta Legislature: Growing government.” In fact, every conservative candidate in Minnesota is peddling the same fiscal flim flam, despite the fact that most of them understand how inflation and budget gimmickry serves to distort.

Still, for a newly minted politician, Mr. Honour has bought into cynical political games remarkably quickly. Plato said “there are three classes of men; lovers of wisdom, lovers of honor and lovers of gain.” Despite the surname, Mr. Honour looks to be, first and foremost, a lover of political gain.

– Loveland

Note: This post was also republished in MinnPost.

I don’t know anything about Mr. DisHonourable, other than he wants to be “King of Minnesota” but I do remember 1984 … I was not in high school … I was (and still am) a taxpayer … although not at the top of the tax bracket (nor am I today) but the rates in 1984 were :

Year 1984

Top Rate on Regular Income

50%

Highest Income Tax Tier

$168,900

Top Rate on Capital Gains

20%

And how does that compare to today :

The tax rate on $168,900 would be at the 28% rate while if you earned at the top tier ($450,000), it would be 39.6%. The person with Capital Gains in the $168,900 range would pay a lower 15% rate while on those at the top tier would pay 20%.

I have no idea what the average corporation paid in 1984, but the GAO just issued a report that the average corporation paid 12.6% now.

The unemployment rate in 1984 was 9.6% versus today at 7.6% with regular and steady cuts in government workers as Obama has reduced the federal employment below Bush’s levels … and states have reduced their numbers also.

Admittedly, I am talking about Federal taxes but since so much of the state spending is tied to Federal matching/participating programs (ranging from Medicaid, SCHIP, police, education, infrastructure, etc.), it is appropriate to consider.

The other side of the coin, that Mr. DisHonourable needs to answer is :

What is the appropriate level of spending would you advocate and how will you generate the monies to pay for it ?

The reality is that this is a pretty simplistic argument … what was gasoline in 1984 (what $1.20 versus today at $3.40) … and one not worthy of someone who wants to be King.